When you sat down with your financial planner to discuss your unique retirement plans and goals, the conversation likely included choosing the most appropriate income annuity options for you and your lifestyle.

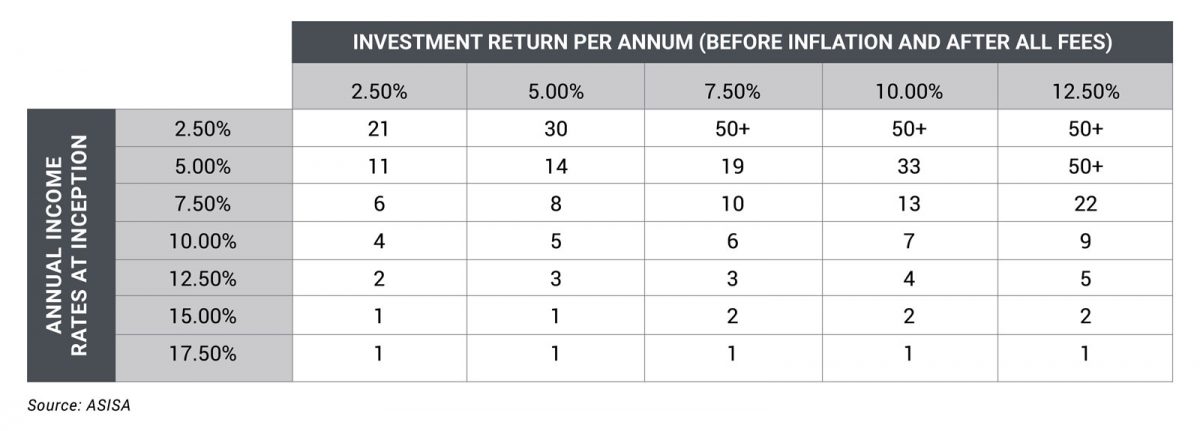

You probably also looked at best- and worst-case scenarios and the likelihood of funds running out in 10, 15 or 20 years. Afterwards, you would have created a strategy to sustain your income and lifestyle, while considering the most appropriate income rate for your living annuity. Your planner used a reputable financial planning tool or the ASISA drawdown tables (see below) to indicate the benefits of drawing a lower income to make your capital last longer. You would have looked at your exposure to equity funds to benefit from greater returns over the long term, grow your capital and sustain income draws.

This probably all made complete sense at the time and you may have chosen a 5% income annually and decided to take on some risk to target an investment return that should give you about 10% per annum. It seemed like the perfect plan.

Then came 2020. The trail of destruction caused by Covid-19 left markets in turmoil. Although we have seen some recovery and growth in certain sectors, the local equity market is still reeling.

Investing in living annuities

Retirees, specifically those who have chosen to invest their retirement funds in a living annuity with exposure to equity funds, are especially vulnerable to these market volatilities. Equity funds are an important component of a well-constructed portfolio for any living annuity, as it allows for capital growth and sustainable income over the long term.

However, in the current Covid-19 investment market, it proves to be a double-edged sword for those who are drawing a high-income percentage from their funds.

Equity exposure, explained

In South Africa, anyone with a living annuity must withdraw a regular income of between 2.5% and 17.5% of their capital per year. This rate can only be changed once a year on the anniversary of the living annuity policy. Investors may opt for a drawdown rate or a rand amount (as long as the amount falls within the 2.5%-17% rule). With the talks of ASISA allowing annuitants to change their income draw rates to accommodate the impact of the pandemic on investment returns, it will be interesting to see what a lower annuity draw rate can do to your overall investment.

Drawdown decisions are key

The initial income drawdown percentage has a significant impact on the overall income longevity and potential capital available.

A higher income draw has a large impact on the longevity of the capital and is detrimental to the fund during a period of bad returns. Time will heal the impact on most members’ retirement savings. However, talk to your financial planner before making any decisions.

Old Mutual Wealth is an advice-led wealth management business, aimed at providing financial planners and their clients with a full suite of industry-leading strategies and services. For more information, go to Old Mutual Wealth.